rhode island tax rates 2021

About Toggle child menu. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Rhode Island Employee Retention Credit Erc For 2020 2021 And 2022 In Ri Disasterloanadvisors Com

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the.

. Exact tax amount may vary for different items The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. 2021 Rhode Island Property Tax Rates Town by Town List Rhode Island Property Tax Rates vary by town. The table below shows the.

State of Rhode Island Division of Municipal Finance Department of Revenue. The top rate for the Rhode Island estate tax is 16. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

If you live in Rhode Island and are thinking about estate planning this. State of Rhode Island Department of Labor and Training Submit. Providence Rhode Island 02903.

Tax rate of 599 on taxable income over. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Any income over 150550 would be.

Rhode Island Property Tax Rates Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort Source. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Any sales tax that is collected belongs to.

Tax rate of 475 on taxable income between 68201 and 155050. Rhode Island State Income Tax Tax Year 2021 11 - Contents Contents Rhode Island Tax Rates Rhode Island Tax Calculator About Tax Deductions Filing My Tax Return Rhode. Tax rate of 375 on the first 68200 of taxable income.

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. Your average tax rate is 1198 and your. Below is a complete list of Property Tax Rates for every town in Rhode Island.

It kicks in for estates worth more than 1648611. Sales Taxes Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Rhode Island. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. Groceries clothing and prescription drugs. The UI taxable wage base will be 24600 for most employers and 26100 for.

Rhode Island State Income Tax Tax Year 2021 11 - Contents Contents Rhode Island Tax Rates Rhode Island Tax Calculator About Tax Deductions Filing My Tax Return Rhode. Rhode Island Income Tax Calculator 2021 If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

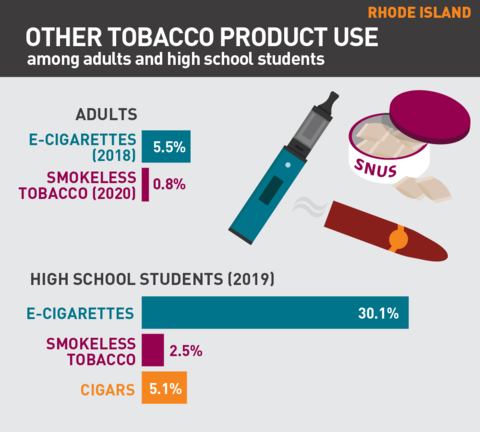

Tobacco Use In Rhode Island 2021

State Income Taxes Updated For 2021 Moneytree Software

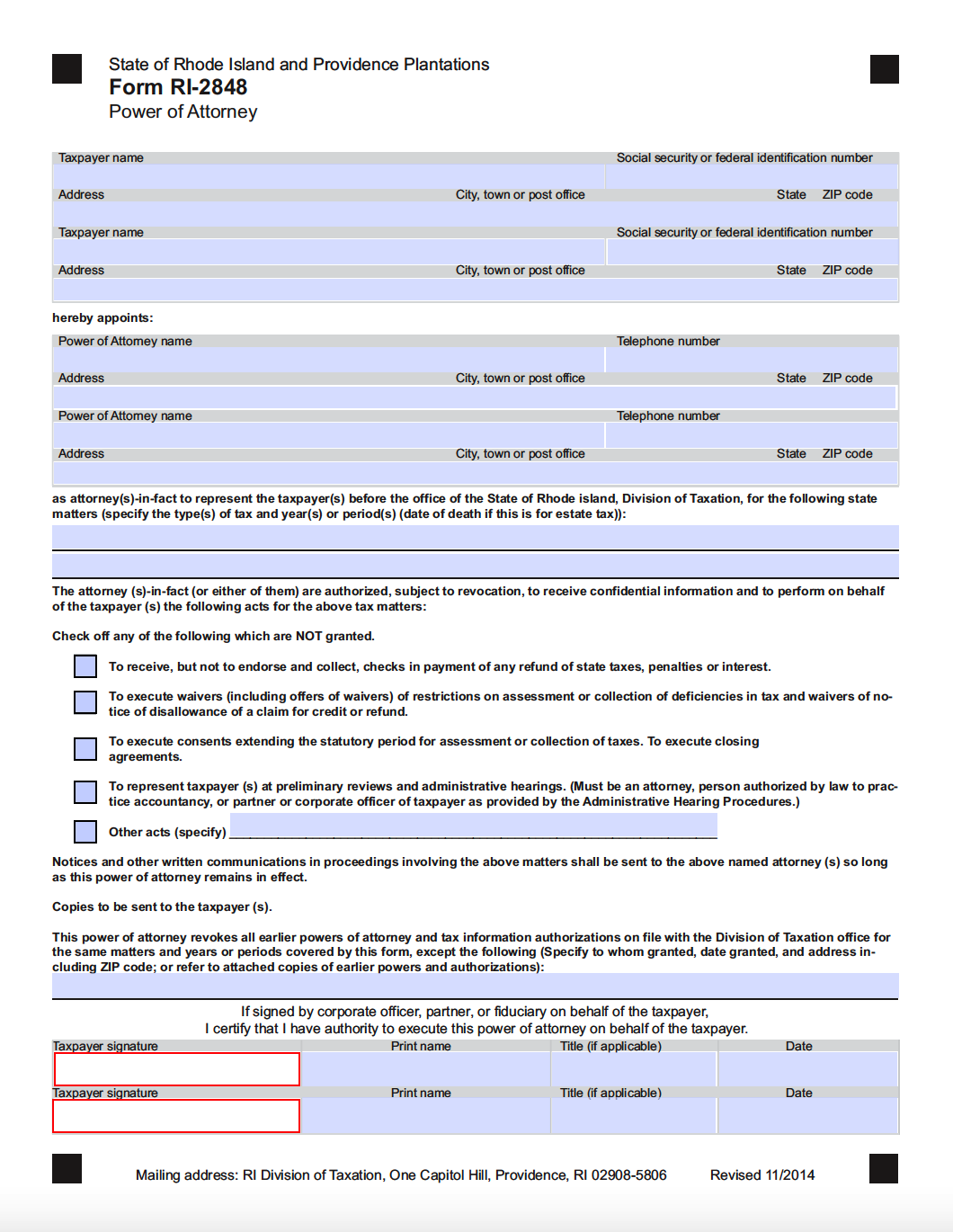

Free Rhode Island Tax Power Of Attorney Form Pdf

State Sales Tax Rates Sales Tax Institute

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Map Of Rhode Island Property Tax Rates For All Towns

State Income Tax Rates And Brackets 2021 Tax Foundation

Is Shipping Taxable In Rhode Island Taxjar

Lists Rhode Island Property Tax Rates

Top States For Business 2021 Rhode Island

Ri Kpi Briefing For Q2 2022 Rhode Island Experiences Employment Gains But Still Lags Nation In Recovery Of Jobs Lost During Pandemic Rhode Island Public Expenditure Council

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

Sales Tax Laws By State Ultimate Guide For Business Owners

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Sales Taxes In The United States Wikipedia

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator